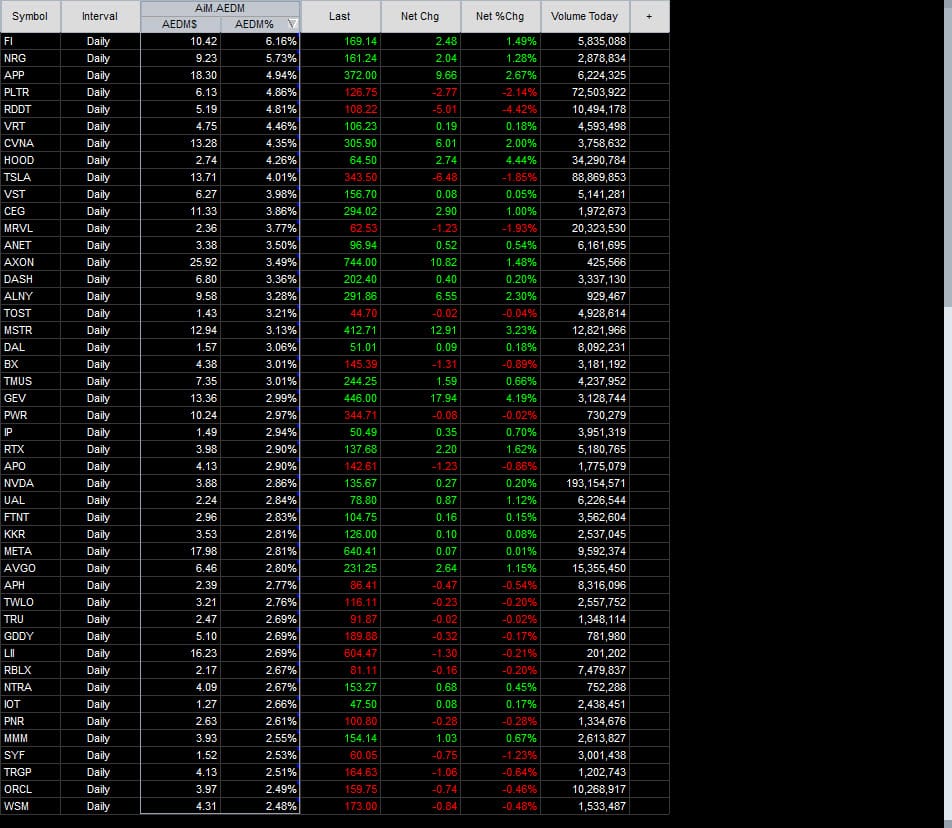

AiM.AEDM

This indicator study for TradeStation calculates the Average Expected Daily Move. It provides traders with a dynamic measure of potential price movement in both dollar and percentage terms, helping to set realistic expectations for daily price ranges and inform risk management decisions.

This post is for subscribers only

Already have an account? Sign in.