AiM.HRP

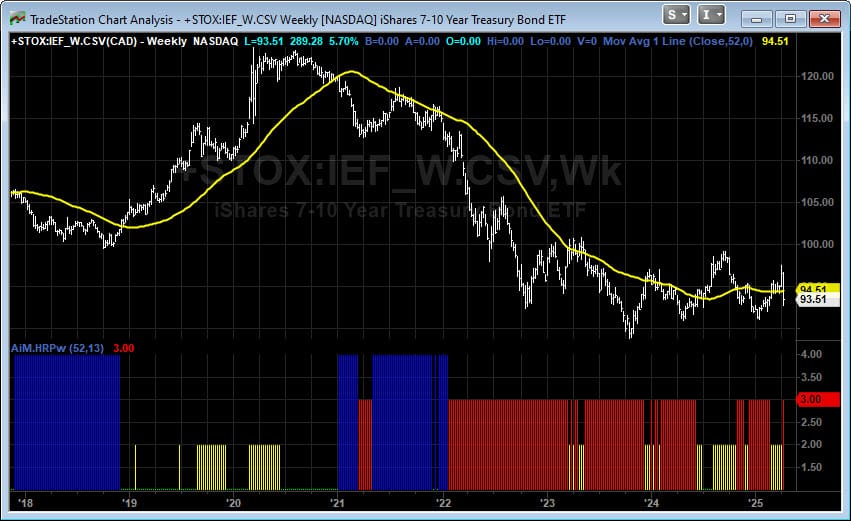

This indicator study for TradeStation categorizes market conditions into four distinct states. It combines trend and volatility measures to provide a comprehensive view of market dynamics, helping traders identify potential long-term trend shifts and market regime changes.

This post is for subscribers only

Already have an account? Sign in.