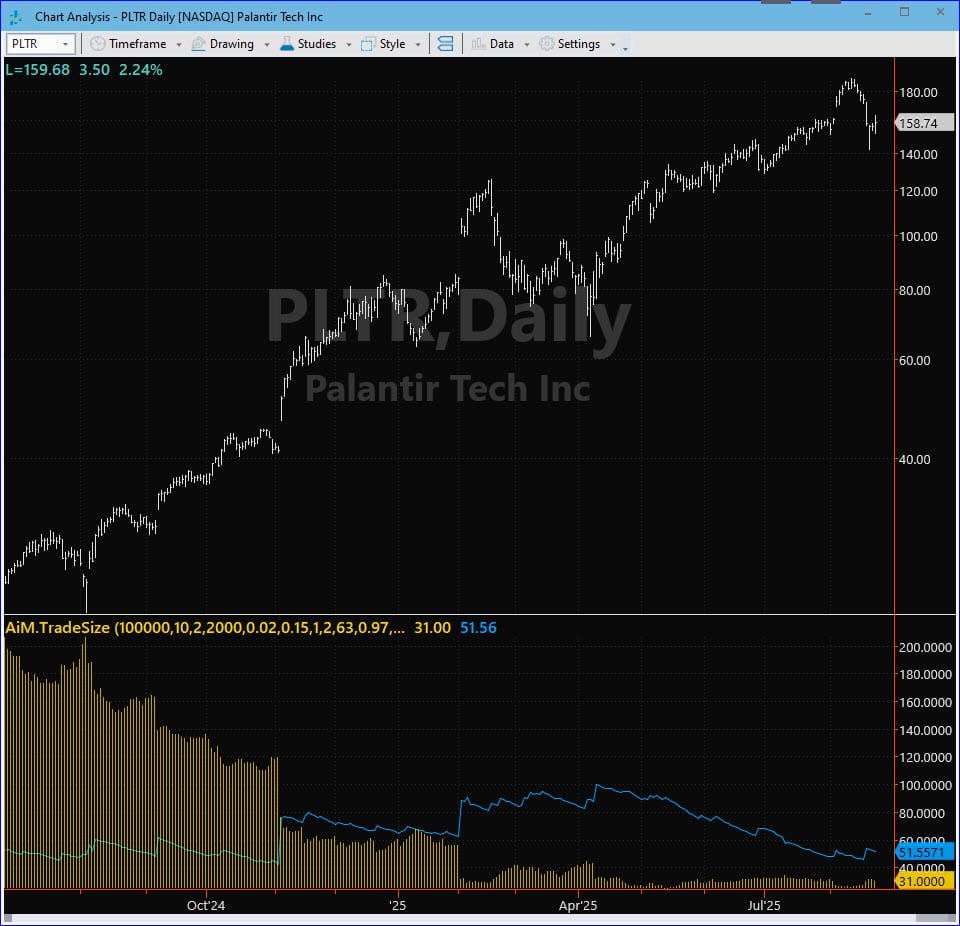

AiM.TradeSize

This indicator study for TradeStation is a volatility-based position sizing tool that calculates the optimal number of shares to trade based on your capital, risk tolerance, and the stock's current volatility.

This post is for subscribers only

Already have an account? Sign in.