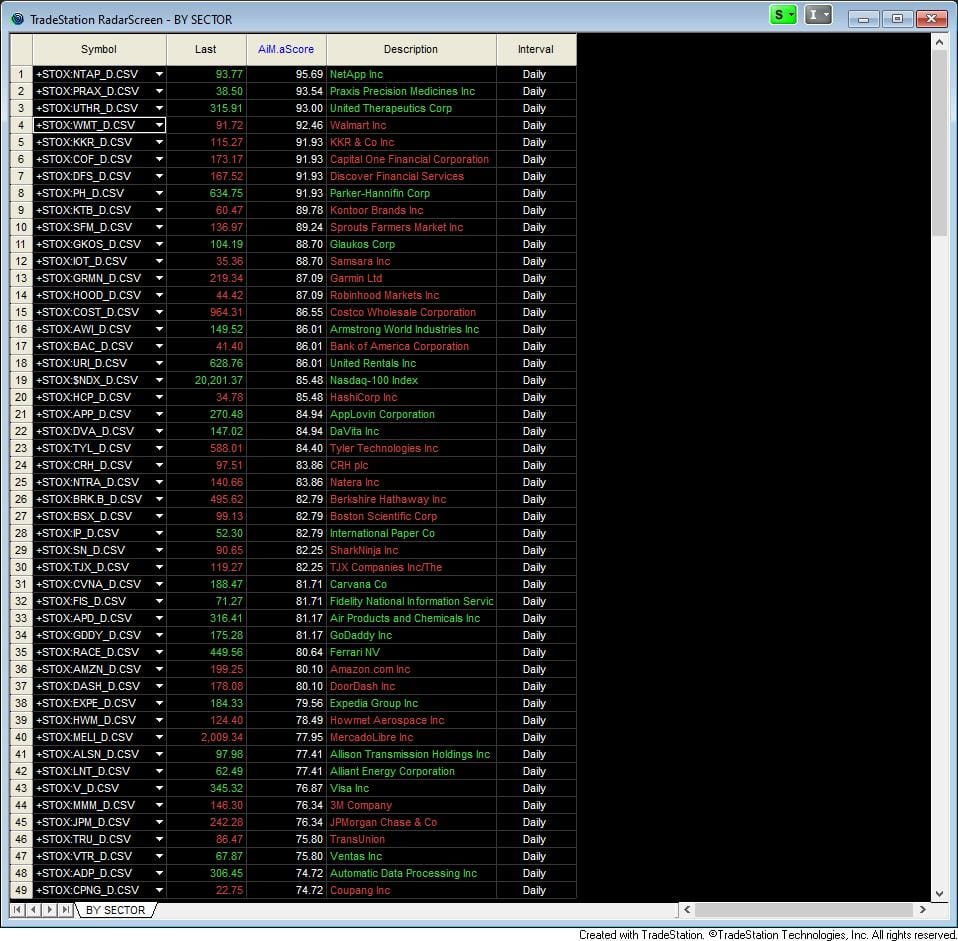

AiM.aScore

This indicator study for TradeStation combines measures of empirical properties of asset returns and ranks these components against their historical values, providing a composite score that helps traders identify potentially significant market movements and changes in trading conditions.

This post is for subscribers only

Already have an account? Sign in.