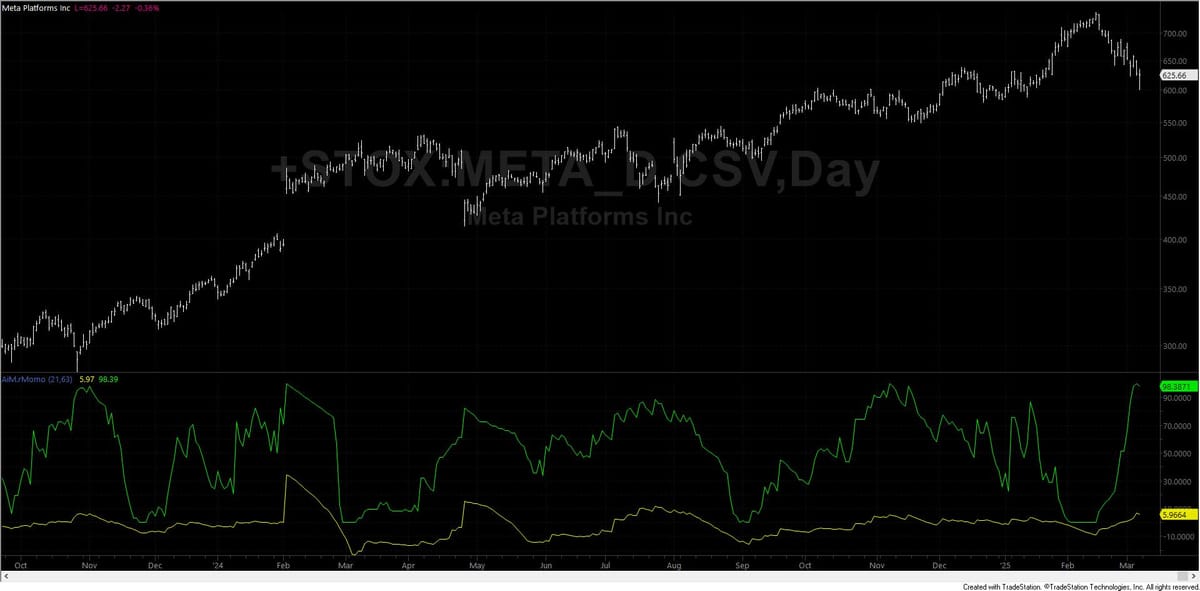

AiM.rMomo

This indicator study for TradeStation compares short-term and long-term volatility to identify potential shifts in market dynamics and ranks the current volatility spread within its recent historical context.

This post is for subscribers only

Already have an account? Sign in.